U.S. HVAC Industry Performance in 2024

The U.S. HVAC industry experienced a dynamic 2024, with emerging HVAC industry trends highlighting both significant growth and key operational challenges. With a rising emphasis on energy efficiency, regulatory transitions, and advanced technologies, the sector set the stage for an even more transformative 2025. Below, we examine the market size, primary growth drivers, challenges, and key takeaways from the past year.

Market Size & Growth in 2024

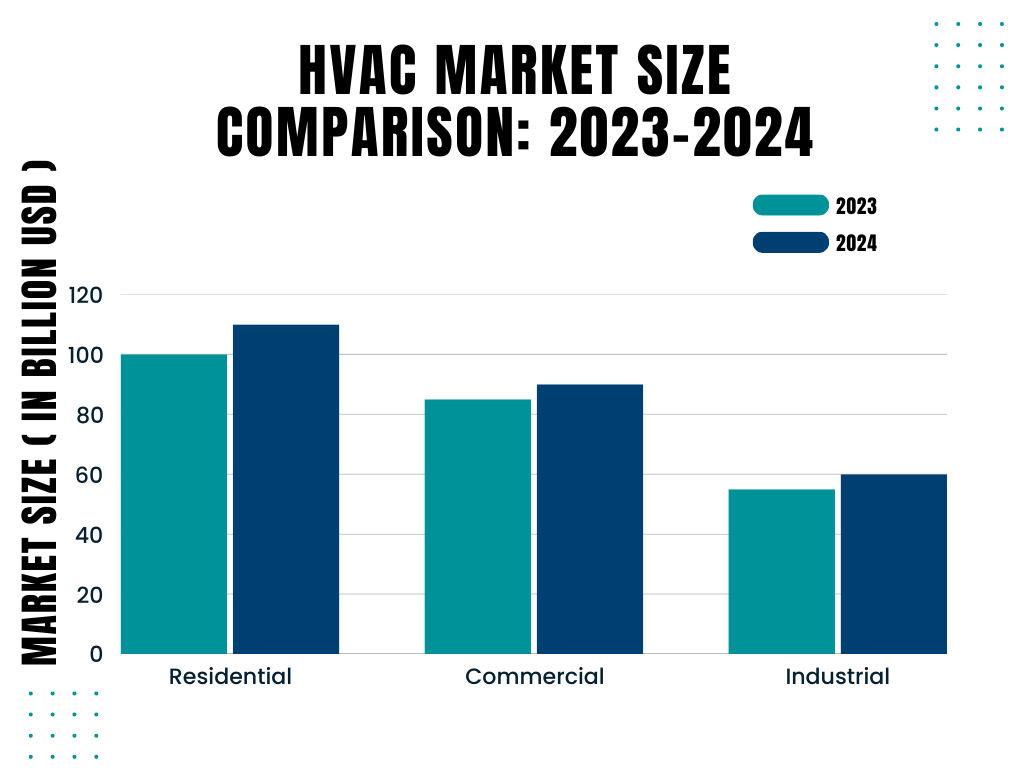

The HVAC industry in the U.S. demonstrated strong performance in 2024, with an estimated market value of $133.7 billion and a CAGR of 0.8% over the past five years(Source: IBISWORLD). Key contributing segments included:

- Residential HVAC (40%) – Driven by home renovations, energy-efficient system upgrades, and smart home integrations.

- Commercial HVAC (35%) – Growth fueled by increased demand for energy-efficient commercial buildings and government initiatives.

- Industrial HVAC (25%) – Led by manufacturing expansions and improved air quality standards in industrial facilities.

Comparatively, the 2023 market size stood at $63.2 billion, reflecting a 6.8% YoY growth. This consistent growth trajectory is a result of increasing demand for climate-responsive solutions, automation, and eco-friendly systems.

Key Drivers of Growth in 2024

Several HVAC industry trends fueled the expansion in 2024:

-

- Adoption of Energy-Efficient Systems – Over 75% of new HVAC installations in 2024 (Source: U.S. Department of Energy) involved energy-efficient models, aligning with stricter DOE and EPA regulations. The push toward SEER2-compliant systems significantly boosted demand.

- Impact of Climate Change & Extreme Weather – 2024 saw 15% more days with extreme heat waves compared to previous years, accelerating demand for advanced cooling systems.

- Smart HVAC & Automation Trends – The global smart HVAC market surpassed $22 billion in 2024, with the U.S. leading in adoption. AI-driven climate control and IoT-enabled HVAC units saw a 29% increase in sales.

Major Challenges Faced in 2024

While the industry experienced strong growth, it also encountered notable hurdles:

- Supply Chain Disruptions – HVAC manufacturers faced a 12% increase in lead times due to component shortages and logistical bottlenecks. This led to higher costs and project delays.

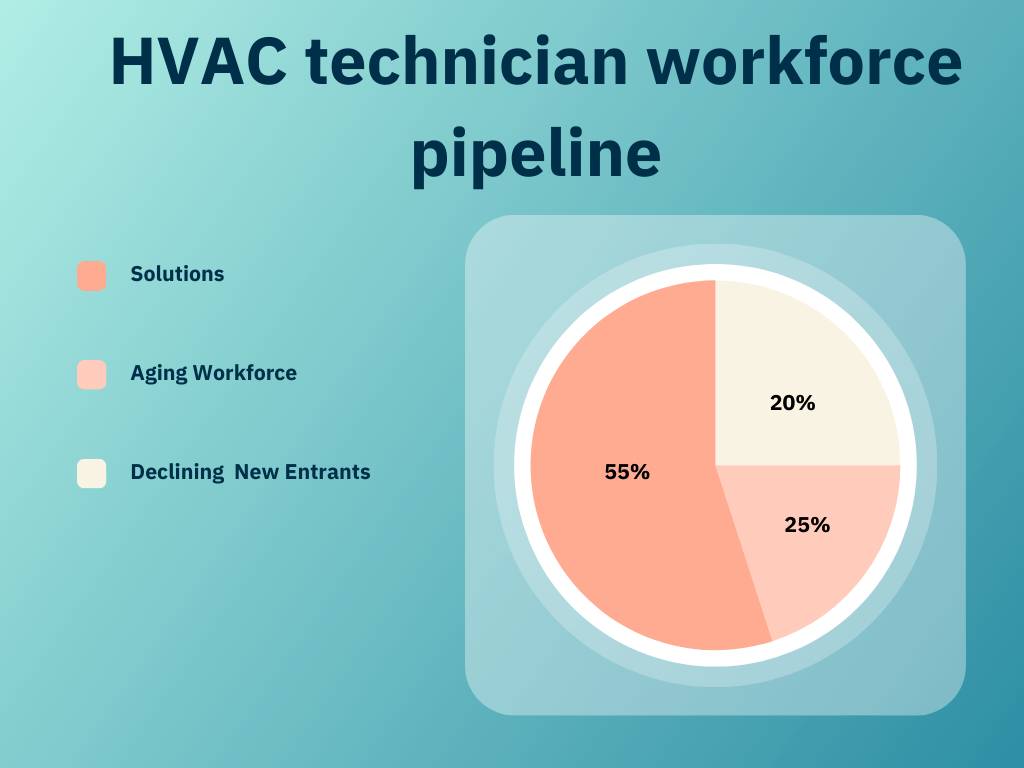

- Workforce Shortages – The industry faced a deficit of 80,000 skilled technicians, impacting service delivery and maintenance efficiency.

- Regulatory Transitions – New environmental regulations, including refrigerant phase-outs, created compliance burdens, increasing operational costs by 8-12% for some businesses.

Lessons from 2024 That Set the Stage for 2025

- The need for workforce development – Companies must invest in technician training programs to address labor shortages.

- Strategic supply chain planning – Businesses must diversify suppliers and leverage predictive analytics to mitigate delays.

- Regulatory adaptation – Staying ahead of upcoming mandates, such as the 2025 refrigerant transition, is crucial to maintaining compliance and profitability.

With these lessons in mind, the HVAC sector enters 2025 prepared to embrace new challenges and opportunities.

Key Regulations, Technological Advancements & Industry Challenges in 2025 (Drivers of Change)

The HVAC industry is set for transformative changes in 2025, driven by stringent regulatory mandates, technological advancements, and persistent workforce shortages. As the sector navigates new refrigerant standards, rising automation, and global market expansion, businesses must proactively adapt to these shifts.

1. Refrigerant Transition Mandates (Impact & Challenges)

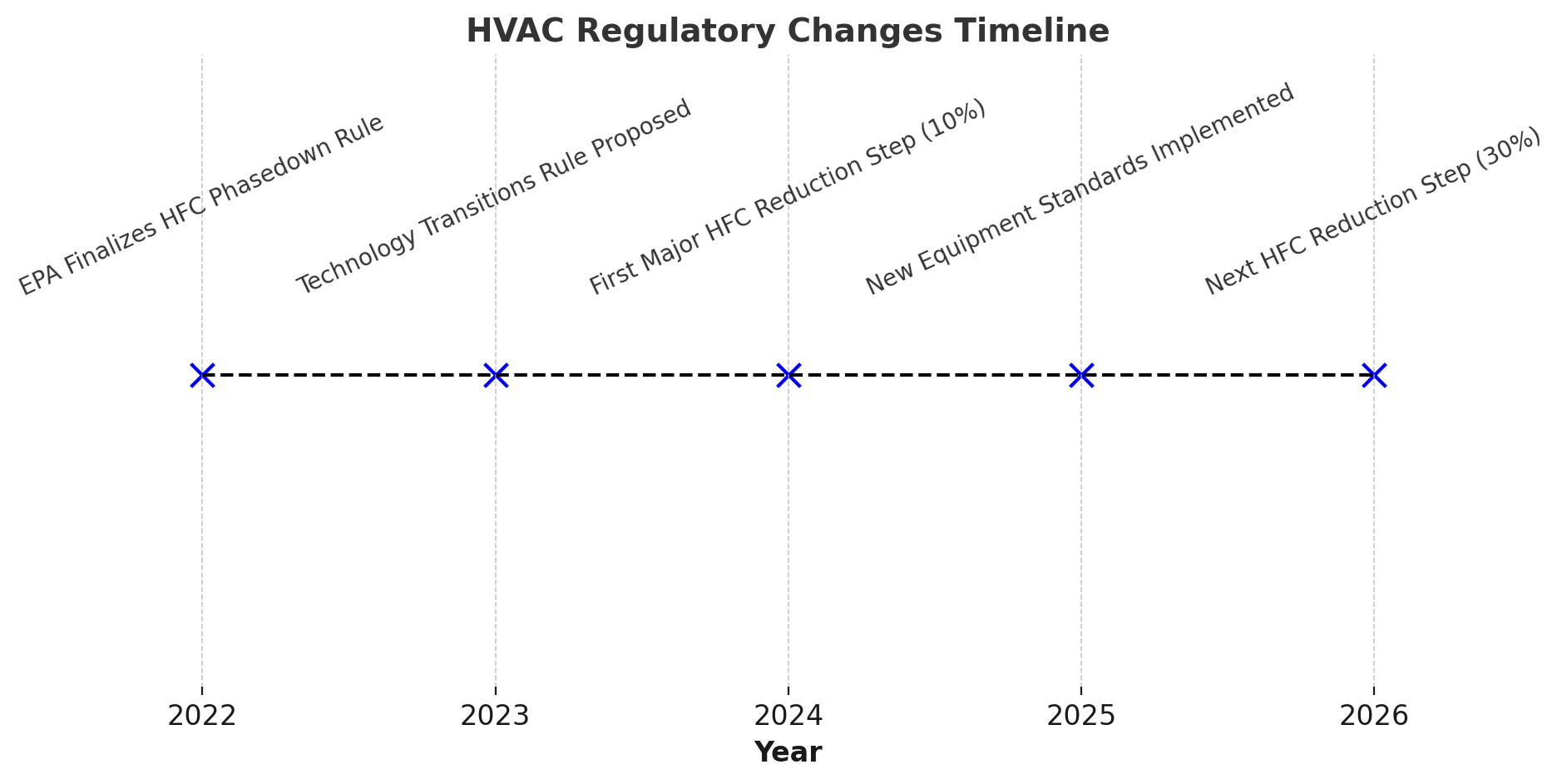

Key Stat: The EPA’s 2025 refrigerant transition mandates a Global Warming Potential (GWP) below 700, phasing out R-410A.

The HVAC industry faces one of its most significant regulatory shifts with the mandatory transition from high-GWP refrigerants like R-410A to environmentally safer alternatives such as R-32 and R-454B. This shift, part of the AIM Act, aims to reduce HFC emissions by 85% over the next 15 years.

Impact on Manufacturers & Service Providers

- Increased Manufacturing Costs – Retooling systems to accommodate new refrigerants will raise production expenses by 8-12%.

- Service & Maintenance Challenges – HVAC contractors will need new training and certifications to handle alternative refrigerants safely.

- Consumer Costs & Market Disruptions – Homeowners and businesses may face higher installation costs due to the shift to new refrigerant-compatible systems.

How Businesses Can Prepare for Compliance

- Technician Training – Invest in updated certifications and safety training programs.

- Inventory Adjustments – Phase out R-410A systems and stock approved refrigerants.

- Regulatory Strategy – Monitor EPA guidelines to ensure compliance while minimizing cost overruns.

2. Labor Shortages & Recruitment Crisis in HVAC

Key Stat: An estimated 225,000+ technician shortfall is expected by 2025 (Source: ZEROHVACR.COM).

The HVAC industry’s workforce crisis remains a top concern, with more than 25% of technicians reaching retirement age while fewer young professionals enter the trade.

Impact on Service Quality & Rising Labor Costs

- Longer Service Wait Times – The shortage will lead to delayed HVAC installations and maintenance, affecting customer satisfaction.

- Wage Inflation – Businesses will pay up to 15% more in salaries to attract skilled labor.

- Declining Profit Margins – Increased labor costs will squeeze contractor and service provider profits unless efficiency measures are adopted.

What Businesses Must Do to Attract & Retain Talent

- Apprenticeship & Training Programs – Partnering with trade schools and offering competitive training programs can build a pipeline of skilled workers.

- Employee Benefits & Incentives – Providing higher wages, signing bonuses, and career growth opportunities will help attract talent.

- Investment in Automation – Leveraging HVAC field service management software can help businesses manage labor shortages by improving scheduling and technician productivity.

3. Rise of Predictive Maintenance & Smart HVAC Technology

Key Stat: Predictive maintenance adoption in HVAC is expected to rise by 23% in 2025.

The adoption of AI-driven predictive maintenance is revolutionizing HVAC service models by reducing breakdowns and increasing energy efficiency. Smart HVAC systems equipped with IoT sensors and real-time diagnostics will become mainstream by 2025.

How AI-Driven HVAC Systems Improve Efficiency

- Proactive Issue Detection – AI-powered analytics can detect component wear before failures occur, reducing unplanned downtime.

- Lower Energy Costs – Predictive maintenance helps HVAC units operate at peak efficiency, cutting energy consumption by 10-15%.

- Reduced Emergency Repairs – Businesses can save up to 25% on maintenance costs by scheduling preventive servicing rather than costly emergency repairs.

Why Businesses Must Invest in Automation & IoT (HVAC Technology Trends)

- Field Service Management Software for HVAC enables real-time tracking, predictive scheduling, and workflow automation, improving efficiency.

- Smart thermostats & AI-integrated HVAC units optimize energy usage based on occupancy patterns.

- Remote diagnostics & troubleshooting reduce service visits and improve operational agility.

4. Growth of the Global HVAC Market in 2025 & Beyond

Key Stat: The HVAC market is projected to grow at a CAGR of 7%, reaching 90.5 billion by 2029 (Source: prnewswire).

The global HVAC industry is expected to see robust expansion, with demand rising across residential, commercial, and industrial sectors.

Which Sectors Will Benefit Most?

- Residential HVAC – Smart home technology and energy-efficient upgrades will drive demand.

- Commercial HVAC – Corporate sustainability initiatives will accelerate the shift toward green buildings.

- Industrial HVAC – Manufacturing facilities will adopt advanced air quality solutions to comply with new safety regulations.

Investment Opportunities in 2025

- HVAC automation & AI-powered systems will dominate R&D investments.

- Expansion of modular HVAC solutions will cater to growing urban infrastructure needs.

- Government incentives for energy-efficient HVAC upgrades will encourage market adoption.

5. The Technology Transitions Rule & Regulatory Compliance

Key Stat: The Technology Transitions Rule enforces GWP above 700 limits on air conditioners and heat pumps (Source: EPA Guidelines).

The Technology Transitions Rule, part of the broader HFC phasedown strategy, will have major implications for HVAC manufacturers and service providers.

What Businesses Must Do to Stay Compliant

- Upgrade Equipment Standards – Shift to low-GWP refrigerants and energy-efficient models.

- Revise Installation & Service Protocols – Implement safety measures for handling next-gen refrigerants.

- Monitor Compliance Deadlines – Adapting early will prevent regulatory penalties and market disruptions.

Financial & Operational Impacts of Compliance Costs

- Higher Initial Investments – Retrofitting HVAC systems to meet compliance standards will increase capital expenditures.

- Competitive Differentiation – Early adopters of compliant technologies will gain a market edge over slow-moving competitors.

- Potential Tax Credits & Incentives – Federal and state policies may offer financial incentives for eco-friendly upgrades.

The HVAC industry is undergoing significant transformations due to regulatory shifts, technological advancements, and sustainability demands. As businesses adapt to new refrigerant standards, automation, and workforce challenges, the market is poised for continued growth. This forecast outlines key trends shaping the 2025 HVAC market, highlighting expected expansion, sector-specific opportunities, potential roadblocks, and the competitive landscape.

1. Expected Market Growth in 2025

Market Expansion & Growth Rate

Prediction: The global HVAC market is expected to grow at a CAGR of 7%, reaching $90 billion by 2029, with steady expansion in 2025.

Key Growth Drivers

- Regulatory Shifts: Compliance with the EPA’s Technology Transitions Rule and the AIM Act’s HFC phasedown will drive the adoption of low-GWP refrigerants and energy-efficient systems.

- Smart HVAC & IoT Integration: The adoption of AI-driven predictive maintenance and smart thermostats will rise by 23% in 2025, reducing operational costs and increasing energy savings.

- Energy Efficiency Demand: Government incentives for green building initiatives will push residential, commercial, and industrial sectors toward more sustainable HVAC solutions.

2. Which HVAC Sectors Will Experience the Most Growth?

Residential HVAC Systems: Smart Homes & Automation Demand

- Prediction: Smart home HVAC solutions will see a 10-15% growth rate due to increasing consumer adoption of AI-based climate control and IoT-enabled thermostats.

- Market Drivers:

- Rising demand for energy-efficient heat pumps.

- Growth in smart home automation integrated with HVAC systems.

- Federal incentives promoting solar-powered HVAC units.

Commercial HVAC Systems: Energy Efficiency Investments

- Prediction: Commercial HVAC will experience a 7-9% increase, driven by corporate sustainability policies and energy efficiency compliance.

- Key HVAC Industry Trends:

- Large enterprises investing in low-carbon HVAC solutions.

- Expansion of district cooling systems in urban areas.

- HVAC retrofits in aging commercial buildings to meet new efficiency standards.

Industrial HVAC: Rising Focus on Sustainability & Compliance

- Prediction: The industrial HVAC sector will see 5-8% growth, primarily due to environmental regulations and increased use of HVAC solutions in factories and data centers.

- Industry Shifts:

- Adoption of high-efficiency air handling units (AHUs).

- Compliance with strict air quality and emissions regulations.

- Expansion of modular HVAC units for manufacturing plants.

3. Challenges That Could Slow Down Growth

While the HVAC market is set for growth, several factors could hinder expansion and create operational hurdles:

Labor Shortages Causing Installation & Service Delays

Stat: The HVAC industry faces a shortage of 225,000+ skilled technicians by 2025.

- Impact:

- Increased installation wait times.

- Rising service costs due to higher wages.

- Limited workforce availability for emerging HVAC technologies.

Regulatory Cost Burdens on Smaller HVAC Businesses

Challenge: Smaller HVAC firms may struggle to absorb higher manufacturing costs linked to regulatory compliance.

- Effects:

- Increased operational costs for refrigerant transitions.

- Limited ability to invest in new energy-efficient HVAC models.

- Potential market consolidation as smaller players exit.

Supply Chain Fluctuations & Raw Material Price Hikes

Challenge: Rising costs of copper, aluminum, and refrigerants could impact production expenses and HVAC unit pricing.

- Key Issues:

- Supply chain disruptions due to geopolitical tensions.

- Higher HVAC system prices affecting consumer demand.

- Increased competition for limited raw materials.

4. Competitive Landscape – Who Will Lead the Industry in 2025?

Major HVAC Manufacturers & Key Players Driving Industry Changes

Top HVAC Companies Dominating Market Share:

- Carrier Corporation – Leading in energy-efficient cooling technologies.

- Daikin Industries – Strong presence in residential & commercial HVAC automation.

- Trane Technologies – Focusing on eco-friendly refrigerant adoption.

- Johnson Controls – Expanding IoT-based smart HVAC solutions.

- Lennox International – Pioneering AI-driven predictive HVAC maintenance.

Innovative HVAC Startups Disrupting the Market

Emerging Companies Driving HVAC Innovation:

- Sealed – Specializing in AI-powered home energy audits & HVAC upgrades.

- SkyCool Systems – Developing radiative cooling solutions to reduce HVAC energy use.

- SensorFlow – Integrating IoT-based HVAC optimization in commercial buildings.

Key Competitive Trends to Watch

- Sustainability-Focused Investments – Companies investing in low-GWP refrigerants & carbon-neutral HVAC solutions will gain a competitive edge.

- Market Consolidation – Larger HVAC firms acquiring smaller businesses to expand service networks.

- AI & Automation Integration – Companies leveraging AI-driven climate control will outperform traditional HVAC providers.

HVAC Industry Trends & Innovations in 2025

The Path Forward in 2025

As the industry steps into 2025, businesses must stay ahead by adapting to evolving HVAC industry trends, embracing smart technologies, and ensuring compliance with new regulations. Sustainability, automation, and customer-centric service models are set to define success in the coming years. Companies that proactively invest in AI-driven diagnostics, IoT-enabled monitoring, and green HVAC solutions will gain a competitive edge.

Now is the time to future-proof your business. Leverage cutting-edge tools, streamline operations, and enhance customer experiences with advanced field service solutions. Is your business ready for the 2025 HVAC transformation?

Take the next step with FieldAx! Experience seamless technician dispatch, real-time monitoring, and automated workflows tailored for the HVAC industry. Book a free demo today and revolutionize your HVAC service management!

Author Bio

Palani Kumar

Palani Kumar is a seasoned digital marketing professional with over 13 years of experience in crafting impactful strategies for B2B brands.

As the marketing lead at FieldAx, he focuses on bridging the gap between technology and business growth, simplifying complex field service management concepts into valuable insights.

Passionate about delivering informative and practical content, Palani writes about industry trends, best practices, and innovations that help businesses optimize their field operations.

When not working on marketing strategies, he enjoys exploring history, engaging in thought-provoking discussions, and appreciating the balance between technology and tradition.